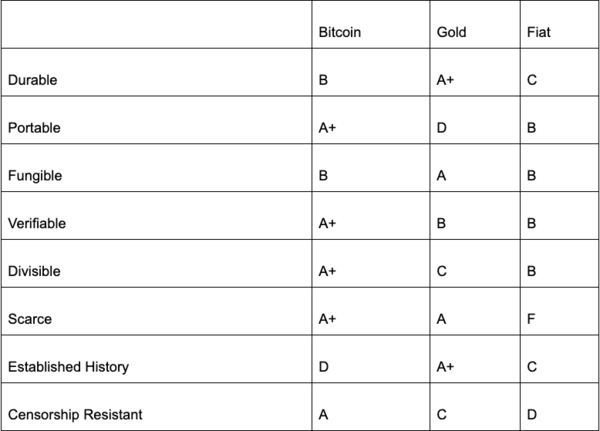

The above Bitcoin report card from Vijay Boyapati lays out the 8 foundational properties of sound money. The scores are given according to Boyapati’s perspective, which I will further examine below in my own thoughts.

Gold wins durability, fungibility, and established history. Bitcoin wins in portability, verifiability, divisibility, scarcity, and censorship-resistance. Fiat money doesn’t win in any of the categories. Taking the chart a step further, I decided to calculate an American GPA for each of the currencies, based on their grades on a 4.0 scale. Bitcoin scored a 3.2, gold a 2.81, and fiat a 1.9. That means Bitcoin is just above a B overall, gold is just above a C, and fiat simply doesn’t pass. For those confused by the scale, a “B grade” is 80%, a “C grade” is 70% and anything below is considered failing. Below are my thoughts on each of the categories.

Durability:

Physically, gold crushes fiat money. Humans have been using gold since 700 B.C and continue to use it as a store of value. You can collect coins today that have lasted through the rise and fall of empires. According to Vijay, “it is not their physical manifestation whose durability should be considered (since a tattered dollar bill may be exchanged for a new one), but the durability of the institution that issues them.” For Bitcoin, the durability lies within the network, growing stronger as the price continues to appreciate. No version of fiat money has lasted the test of time. If history repeats, we can expect too that one day the dollar will join the ranks of worthless paper.

Portability:

This is a no-brainer win for Bitcoin. We live in a digital age where information can instantly be transported through a screen anywhere in the world. Transporting gold is a nightmare, which is why most of the world’s supply is buried underground – it’s so cumbersome. Fiat today is mainly digital, but transporting large amounts across a fractioned financial system is difficult and still faster by a jet. Gold can be represented digitally, however you are only dealing with the title of ownership, not the actual asset. That’s one reason why Bitcoin dominates this category. With private keys, you are in complete possession of the coin that can be sent anywhere in the world.

Fungibility:

Vijay’s score here surprised me, at first impression, I would have scored Bitcoin the same as gold – both an A. But Gold’s higher score makes sense because only gold can be melted down, erasing its past. It can be accurately measured and then swapped for equal gold. Because of the cryptographic nature of Bitcoin, “tainted” coins can be traced, making some merchants reluctant to accept them. The fungibility of fiat is only as strong as the word of the government. It has occurred in the past where governments discontinue bills, removing fungibility. This could occur if the U.S. government decides to eradicate coins and, as a result, coins then trade at a discount relative to their face value.

Verifiability:

I slightly disagree with Vijay here and would have given all of them a B. All three can be accurately verified, but Vijay detracts from Gold and fiat because counterfeiters have historically fooled people with these two assets. There have been cases in crypto where people have bought Bitcoin Cash thinking it was Bitcoin because they fell prey to false or poor advertising. All three have their own tests for verifiability that can give a correct answer with 100% certainty.

Divisibility:

This is another simple win for Bitcoin. Bitcoin breaks down into units called Satoshis that represent 0.00000001 BTC, or one hundred millionth of a Bitcoin. Satoshis are much simpler to transact with than gold, which would need to be physically broken down for everyday use. Fiat deserves its solid score, but up against the units of Bitcoin, no asset can compare.

Scarcity:

I think Vijay was a little generous with gold here, I personally would have knocked it down to a B citing speculation that gold likely exists on asteroids and below the ocean floor. Gold’s supply has remained scarce historically due to the control of governments, but Bitcoin has a fixed supply of 21 million that is unalterable. As for Fiat, it deserves its failed ranking because the money printer really does go brrrrrrr!

Established History:

Gold is the obvious winner here since it has stood the test of time. Bitcoin has only been around since 2009, a fraction of the US dollar’s existence. Sahil Bloom just recently wrote about the Lindy Effect and how the longer Bitcoin stays around, the more likely it is to remain. Vijay cited this effect and said that if Bitcoin is around for another 20 years, its trusts will reach a universal level equivalent to the acceptance of the internet.

Censorship Resistant:

This attribute is the earmark of Bitcoin. At a time where governments are crafting destructive monetary policy equating to socialism for the rich and capitalism for the poor, Bitcoin’s policy remains untouchable and intact. If the hand of the government or powerful can grab ahold of the money, then the asset isn’t censorship-resistant. In the past, gold has been confiscated and miners can increase the supply by ramping up mining efforts if they please. It is true that Bitcoin has lost some of its anonymity with improved tracing technology, but it has retained its permissionless status since its inception. By its very nature, it circumvents 3rd party intermediaries that facilitate transactions and it lives on its own accord.

Overall, this was just a thought experiment and the rankings were just from one Bitcoin user. I’m sure many people would have strong counter views to what I said above, but I tried my best to be as fair and accurate as possible with my reasoning within each category. If you think Bitcoin deserves to be crowned king, make sure you are buying the dip.