Buy the dip: an age-old mantra used by traders and investors to describe the activity of adding to their portfolios when the price of an asset drops. It has historically been proven to be one of the best ways to compound wealth.

History Says it All

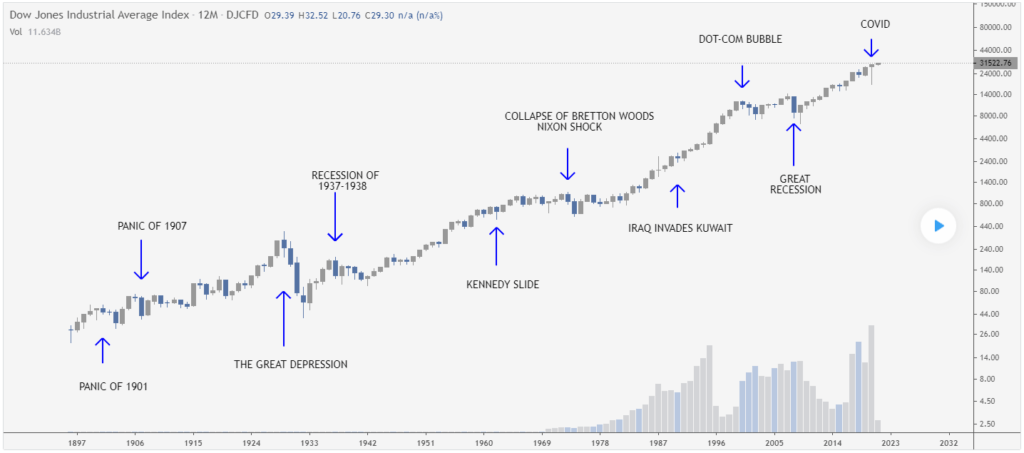

To illustrate the power of buying the dip, look at the chart below showing the Dow Jones Industrial Average since 1896. There have been a number of crashes, bear markets, and recessions over the past 125 years. I have marked each of the most notable events on the chart.

As is painfully clear, every single dip, including The Great Depression, was an opportunity for cash-flush investors to buy stocks at extreme discounts with a long time horizon. With the stock market presently near all-time highs, there has literally never been a bad time in the history of the stock market to invest in equities.

When viewed through this lens, you can see how essential it is to zoom out and consider a multi-decade time horizon for investments.

As Warren Buffett once famously said, “the stock market is a device for transferring money from the impatient to the patient.” Short-term decisions are what make investors lose money: “If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.”

Markets trend up over time. Depressions, recessions, and bear markets have always been temporary and are the best buying opportunities.

Does this work with Bitcoin?

Now apply this logic to Bitcoin. Imagine the Bitcoin chart ultimately reflects similar growth to the stock market over a long time horizon. Logically, there’s no reason for this not to occur. Considering this, it is likely that we are very, very early.

Even with the 10 years that Bitcoin has been around, it is already showing these signs. Had you bought at any of the dips, you would have either 2x, 10x, 100x, or more on your investment.

Patience is a Virtue

Thus the most important rule is patience. It is almost impossible to call the top or the bottom of any market, let alone one as volatile as crypto. Just this week, we saw a dip of almost 20% in a couple of days. With daily volatility sitting so high, one needs to zoom out as I mentioned above.

This means the “buy the dip” mantra is for long-term investment, not to pay for your daily bills.

Peter Brandt touched on the idea of patience in markets and buying dips in our interview below – around 41:30.

“Buy stocks and hope they go down. Buy good companies and hope you can buy em cheaper… Buy them and hope that they go down 50% because you can dollar cost average your whole life and you’ll do very well doing that.”

We are actually seeing this strategy playing out with the big investment firms, specifically Square and MicroStrategy. Yesterday, Square announced that the firm had added another $170 million to its balance sheet during the dip. The same day Microstrategy announced the purchase of an additional $1 billion in BTC.

If you want to learn more about what great investors like Warren Buffet say about investing, read “The Greatest Investors are Adamant.”

Written by Scott Melker & Joshua Mapperson.