I was beginning to write up a quick primer on stop losses and then found this strategy which is a good place to start. First off, I ALMOST ALWAYS move my stop losses into profit when a trade goes my way. This allows me to assure I lock in some gains and avoid a loss on a potentially profitable trade. This is especially true in the crypto market where a sudden move in Bitcoin can quickly destroy an altcoin setup. Although, legacy markets look the same now as well.

Most crypto exchanges do not offer a full breadth of orders – they only have simple stop market/limit and take profit orders. A “real” exchange usually has OCO orders (one cancels the others). This means that you have the luxury of both setting a stop loss and a take profit order on a position. And when one fires, the other is canceled.

Legacy exchanges also have trailing stops. These stop losses move up at a certain percentage or fixed amount behind price, locking in gains on the way. This was always my favorite strategy as a stock trader. Since we do not have these orders on most crypto exchanges, we are forced to do it manually. I prefer to set my trailing stops based on chart levels rather than fixed percentages, but both are viable strategies.

The Basic Steps of my Trades

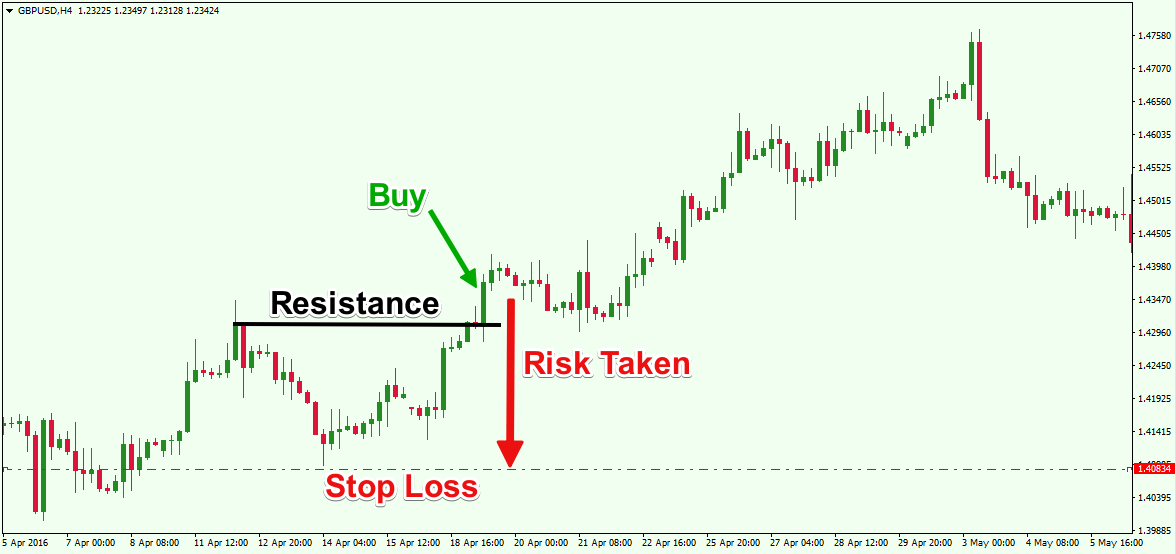

- Open a position and set the stop loss immediately. I base position size on where I want my stop loss and the size of my portfolio. If the exchange has OCO orders, I also set my take profits. If not, I use trading view alarms at the areas where I am interested in taking profit.

- For trades that go against me, I stop out and move on with my life.

- For trades that go my way, I start to lock in the gains.

- I move my stop loss up first to my entry point to guarantee that I do not lose.

- Assuming price continues to rise, I move my stop loss up just below the next key level of support on the chart. Putting your stop right at support makes it more likely it hits on a retrace. So avoid doing this and avoid clear psychological levels. For example, if support is $10.20, I want to make sure my stop is somewhere below $10, an obvious level where traders will be watching.

- I continue to move my stop up to just below each key level as price rises. Eventually I will stop out well in profit when the trade finally reverses.

The Do’s and Don’ts of Stop Loss Strategy

Stop losses in obvious areas are likely to be “swept” or “hunted.” You do NOT want your stop to ever be where everyone else’s are likely to be sitting. If they are, large players will understand this and use your orders to fill their positions. Remember, your stop loss is a sell order, which mean that if someone want to fill a ton of buy orders, they will push price to the area where all of those stops are sitting to trigger the sells. That is why we see SFPs, which I often discuss.

You cannot have your stop loss too tight. A common error that traders is make is setting an extremely tight stop because their position is too large. It’s better to have a wider stop and smaller position size to avoid being stopped out on a normal price fluctuation or stop hunt.

A proper stop loss strategy requires a ton of experience and hours watching price action. You WILL GET STOPPED OUT OFTEN right before price reverses and goes the way you intended. It’s part of trading. That said, the benefits of using a stop loss over a large sample size will far outweigh the negative.

ALWAYS USE A STOP LOSS! If you want to learn how to trade gaps, check out this blog.