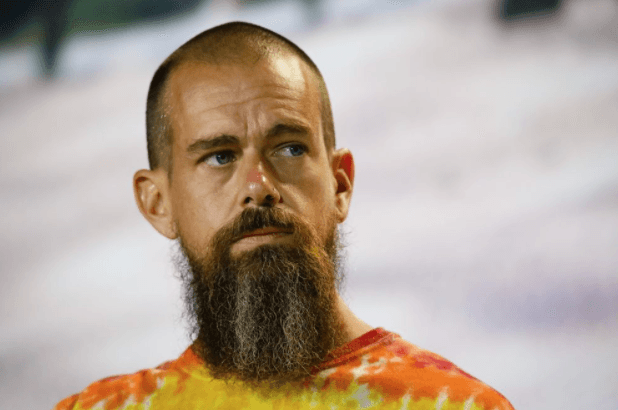

In the Wolf Den Newsletter, a little ways back, I briefly covered some of the Web 3.0 drama that is circulating on news sites and Twitter. I was expecting this to be another round of FUD stemming from current bearish sentiment, much like Chinese bans, energy consumption, the argument that Bitcoin is “only for criminals” and such. That’s how my brain works as a crypto investor – I default to FUD. But to my surprise, the more I peeled back the layers of the debate, the more I realized that it is somewhat valid and that it is more nuanced than an argument between upset bag holders and petty tribalists. When Jack Dorsey and Elon Musk find confluence in an idea that is met with community backlash, it is worth taking a deeper look. Before I share my thoughts, I’ll get everyone up to speed.

I’m not suggesting web3 is real – seems more marketing buzzword than reality right now – just wondering what the future will be like in 10, 20 or 30 years. 2051 sounds crazy futuristic!

— Elon Musk (@elonmusk) December 20, 2021

The debate first became public when Elon Musk began poking fun at Web 3.0 on December 19th, you can view the tweet HERE. Musk’s jokes continued, but things really began to heat up a couple of days later when Jack Dorsey joined in and took the critique another step forward. On December 21st, Dorsey retweeted an image and captioned it with an emoji of “100,” which is slang for being in full agreement.

— jack (@jack) December 21, 2021

The implications were clear – each part was labeled, meaning there is little room for interpretation. We know what Jack was saying.

After seeing the backlash against both tweets, it became clear that these billionaires were in the minority in their feelings towards Web 3. This is significant.

There is one distinction I want to make clear. This isn’t the same old Bitcoin vs. Ethereum debate. It’s a debate about freedom of money vs. corporate monopoly of crypto. Bitcoin and Ethereum have become proxies for each side, but this argument involves far more people than just the passionate communities of the two largest coins. It drives to the heart of the core principles of the crypto world.

Since a lot of the heat has been pointed at Ethereum, let’s take a step back and review some early crypto history. Vitalik Buterin, the founder of Ethereum, was inspired by Bitcoin. Before he created Ethereum, he wrote articles for BitcoinTalk and was compensated in Bitcoin for his work. Did you know that Vitalik was also the founder of Bitcoin Magazine? Did you know that Vitalik contributed to Ron Paul’s campaign years ago because he felt a strong alignment with the Libertarian values of individual freedom? There is an entire chapter in The Infinite Machine dedicated to Vitalik’s early obsession with Bitcoin.

It’s really hard to imagine Vitalik created a platform with the intention of helping the VCs. But we all know intentions and reality are entirely different so let’s look deeper.

Vitalik was inspired by Bitcoin because it represented the idea of uncorrupted money, safe from greedy VCs, and government officials with access to a money printer. Bitcoin was his obsession, but he ultimately wanted to build further, which was impossible on his beloved coin. Ethereum was designed to make up for Bitcoin’s lack of programmability, while still upholding the same set of values. Etheruem was the solution to fill a void, it answered Vitalik’s obsession to build by expanding upon blockchain technology. If Vitalik had it his way, he would have programmed on top of Bitcoin, he actually tried really hard and it simply didn’t work out.

You can make the argument that some of crypto’s ideals were lost in the process of building Ethereum, but the idea of a decentralized, community-driven, open-source technology still motivates and drives Vitalik’s decision-making. When you offer a decentralized platform for people to build on, you naturally accept both the good and the bad.

From Jack’s point of view, Bitcoin’s design prevents manipulation by greedy individuals. On the other hand, Ethereum and Web 3.0 lack the squeaky clean record of Bitcoin. Because new businesses are being built, these platforms are a breeding ground for cash grabs by big money. Hence the jab at VCs, who get early access at bargain-basement prices on the coins that the public buys for 100x the price.

As Jack puts it, “meaningful breakaways from the corporate establishment are definitely possible, both big and small! No one rich individual or institution has any more power over Bitcoin than anyone else. It was attempted in the past and failed.” Jack is saying that Ethereum is not a meaningful breakaway – rather it’s a new shiny toy for big money.

Also worth noting is that Web 3.0 is not limited to Ethereum. Ethereum is the easiest target because it is the largest. There is a seemingly endless amount of Web 3.0 coins that serve similar roles, some of which are earth-shattering technologies, while others admittedly were designed with blatantly bad intentions. There are also an endless amount of shit coins built on Ethereum and other Layer 1s that add nothing to the conversation. Some are flat-out scams.

That’s the reality of layer 1s.

Both sides have a valid point. Without Web 3.0, we wouldn’t be able to discuss giving power back to artists (NFTs), giving power back to individuals (DAOs), giving power back to gamers (metaverses), and giving power back to developers (smart contracts and DAPPs). DeFi would not exist.

But with great power comes great responsibility (well-timed Spiderman reference). Bitcoin clearly has a cleaner record and clearer vision when it comes to positive financial change – Ethereum not so much. Both coins have their issues, and from that starting point, there is an endless array of problems (and possibilities) as you go further down the risk curve. It’s when you open up Pandora’s Box ie. Ethereum, you open up the realm of possibilities. Nobody said that changing the world financial system and challenging the very nature of transacting would be easy. These are growing pains.

When Jack Dorsey and Elon Musk speak up, their concerns are worth considering. Even if they are not entirely correct. With that being said, I want to point out that there are other versions of understanding this debate that are equally correct.

The reason that "the people" don't benefit from early investment in new projects isn't a fault of Web 3 – it's the result of shitty regulation that only allows funds to be raised from accredited investors.

This is the same in every industry, not just crypto.

— The Wolf Of All Streets (@scottmelker) December 24, 2021

On Twitter, I made a case as to why lack of regulation is the real problem, and others looked more closely at the nuances of technology. And to that end, I am sure there is much deeper additional evidence behind Dorsey’s claims that don’t meet the eye. Regardless of the side, you stand on, what matters most are the intentions behind your beliefs and actions. At the end of the day, we all want positive change.

If you are caught in the middle, then read this article titled, “ Bitcoin Is Only For __”