Crypto Beginner Series EP 11: The Language of Crypto Pt. 2

Back in August of this year I released a blog covering the language of crypto. But I was only able to scratch the surface of the diction used in our space. Now back for part 2, I go over an entirely new set of recent and important vocab.

Any newcomer of any financial market must learn the native language of that market. The crypto space is no exception to this rule. It brings a complex vernacular that is far from intuitive and literally cryptic at times.

The origin of the language of crypto lies at the intersection of cypherpunks and cryptographers, mixed with hedge funds, Wall Street icons, retail meme stock traders, and degenerate gamblers. The language of crypto acts as a rite of passage. It proves one has done their research and can play the game. As the space develops, so too does the slang, jargon, and euphemisms. “Lettuce hands” is an insult, “apeing” is a viable strategy and “HFSP” is the ultimate snarky response. To an outsider, these terms are non-intuitive and sound outright ridiculous.

The language however isn’t just comedic. It also serves an integral role in describing a new frontier of finance ready to displace the old way of doing things. There is comfort in our language, though. It’s our tool to make sense of the innovation around us, while also shielding us from the hostility that our community has faced for more than 10 years. Below is an alphabetical guide to some of the most important and confusing terms and phrases you need to know today. Read the list over until you commit it to memory.

Welcome To The Language Of Crypto Pt. 2

ATH – When prices reach and surpass the highest point they have ever hit. Stands for “All-Time High.”

API – The software needed to allow applications to talk to each other. Stands for “Application Programming Interface.”

Arbitrage – Buying and selling the same asset with the intent to take advantage of price discrepancies on different markets/platforms.

Black Swan Event – A rare occurrence that brings severe impact to markets. They aren’t predictable and can be extreme.

Block – The component of a blockchain containing a specific amount of important financial data on the ledger.

Cold Storage – The safest way to store your private keys, which requires the keys to be offline.

Collateral – Any accepted asset a lender accepts from a borrower when issuing a loan.

DAO – A group that follows a specific set of transparent and agreed-upon rules. Stands for “Decentralized Autonomous Organization.”

Degen – An irresponsible trader that concerns themselves with pump and dumps.

Double Spend – One of the original problems Bitcoin set out to fix: when one set amount of currency is accidentally spent twice.

ETF – A security traded on an exchange that comes in many forms and oftentimes tracks a basket of assets.

Exit Scam – When the founders disappear and the business shuts down after collecting investors’ money.

Fiat Onramp – Where you can convert fiat to cryptocurrency, typically an exchange.

FOMO – A feeling of apprehension, especially dangers for investors or traders who act irrationally. Stands for “Fear Or Missing Out.”

GM and GN – Common greetings at the beginning or end of the day to crypto friends. Stands for “Good Morning” and “Good Night.”

Halving – A programmed event that occurs roughly every 4 years to Bitcoin, cutting the block reward in half to reduce supply output.

Howey Test – A set of questions created in 1933 by the SEC to determine if an asset is a security.

Interoperability – The ability for different blockchain protocols to be able to communicate with one another and share data.

KYC – A common requirement business entities collect to verify and legitimize their user. Stands for “Know Your Customer.”

Laser Eyes – A popular trend amongst Bitcoiners that symbolized the inevitability of Bitcoin hitting $100,000.

Liquidity – The ability of a market participant to buy or sell an asset without drastically affecting the asset’s price.

Leverage – Borrowed money, allowing a trader or investor to take on a larger position than what they normally would be able to.

Margin Call – If the collateral or trade falls below a certain level, the broker calls the borrower and asks for more assets to cover the losses. Not doing so brings the possibility of a liquidation.

Meme Coin – Tokens that were created strictly as a joke that lack utility and run off hype and fun marketing.

Noob – Someone new to any job, skill, sport, or sector. In crypto, retail traders are often considered noobs.

Overbought – Occurs when a cryptocurrency has been bought a significant amount. This technically happens when RSI is 70 or above.

Oversold – Occurs when a cryptocurrency has been sold a significant amount. This technically happens when RSI is 30 or below.

Paper Trading – A form of simulated trading where no real money is involved, but everything appears to be identical to the real world.

Private Key – Similar to a password, this code allows you to access your cryptocurrency. Similar to the key to your safe, it is not meant to be shared.

Pubic Key – Similar to a username, this code allows others to be able to send cryptocurrency to your wallet. Think of it like your PO box or home address.

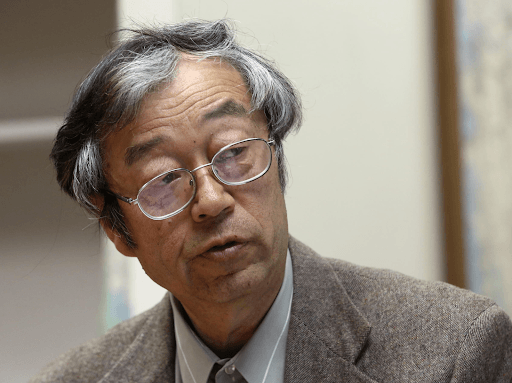

Satoshi Nakamoto – The pseudonymous creator of Bitcoin back in 2008 that wrote the original white paper and code for the asset.

SEC – One of the most powerful governing bodies in the U.S., headed by Gary Gensler. This agency concerns itself with investor protection. Stands for “Securities And Exchange Commission.”

TVL – The sum of all assets locked in smart contracts in DeFi, a number that has generally grown over time. Stands for “Total Value Locked.”

Web3 – The next generation/evolution of the internet focused on more intelligent, connected, and open-source opportunities.

WSB – A massive finance group on Reddit, comprised of the “little guys” ignored for years, but now hold the power to start a movement.

Yield Farming – The collection of interest in DeFi from depositing funds into protocols, smart contracts, or liquidity pools.

Now that you can speak the language of crypto, it’s time to play the game. Learn everything you need to know from our huge blog collection.