Sentiment and emotion drive our decisions, our perception of reality, and macro trends in society. As Bitcoin continues its march into uncharted territory, tracking sentiment will become vital for properly scaling out of your crypto holdings when in profit. Here are some signs to look for in the final stages of euphoria so you can get out before waiting for another cycle.

To be clear, I am not saying you will ever sell all of your Bitcoin. I am merely offering prudent ideas for taking profit at an appropriate time, especially as a trader.

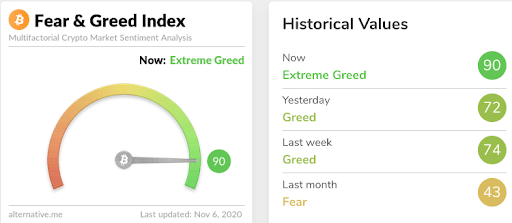

Our top signs of crypto euphoria include, family members finally showing interest, crypto investors buying Lamborghinis, everyone suddenly supporting a coin they used to call a “shitcoin”, celebratory and mocking memes and videos, humble people publicly bragging about their profit, the Fear & Greed Index at +90, everyday normies joining the space, people stating they will never sell, hearing about crypto in public, newbies explaining crypto to veterans, every major news channel talking about crypto, people checking the price way more than usual, losing sleep over price, absurd price predictions, the Bitcoin narrative changing, and haters denying ever hating crypto.

Many of the items on the list probably sound comedic, but euphoria makes people act in strange ways. Our top 3 signs of euphoria are the Fear & Greed Index at +90, absurd price predictions, and a changing narrative.

The Fear & Greed Index

The Fear & Greed Index at +90 paired with the other signs is a strong signal that the market is euphoric. It has already hit the mid-90s multiple times of late and will continue to do so. This metric alone is a bit of a meme. But when greed remains prevalent and the other signals arise, it’s worth paying attention.

Absurd Price Predictions

Absurd price predictions are our next top euphoric sign. Most Bitcoin price predictions have ranged from 50k-300k since the pits of the bear market. When Bitcoin starts to approach these price levels and the predictions shift to 500k -1M, we will likely be approaching the top. This happened during the last bull run as the price approached 15K. People thought that selling at 20K was “way too early” because 100k would be the actual top. Don’t fall prey to a new set of price predictions even if they gain traction in the community. The predictions made when euphoria is not present are far more likely to be accurate than those made during the height of the hysteria. This is much like setting a price target as a trader and then refusing to sell when it hits because now that price has arrived you think it has to go higher.

The Narrative Changing

The last and final sign of euphoria is a coin’s narrative changing. Bitcoin’s popular current narratives are that it’s a store of value, digital gold, a medium of exchange, and a portfolio hedge. These narratives were forged from academic studies, community alignment, and a historical track record – not as a result of elevated emotions. When people start shouting Bitcoin is a “new world reserve currency” or a “currency to end all currencies,” we are likely at the top. Just because the price goes up does not mean the narrative has to shift with it.

The only way for the largest players to sell at the top is to have a deluge of new suckers to buy at that price. Don’t be one of those suckers.

We will continue to monitor sentiment as the market matures. We will collectively track the euphoric signs, and strategically take as much profit as possible along the way.