One of the largest deterrents to first-time Bitcoin buyers is the expensive price tag. For many newcomers, shelling out tens of thousands of dollars to own one coin doesn’t carry much appeal. Especially when you could own 10, 50, or 5,000 of another coin at an equal cost.

For uninformed crypto investors, the less capital they have ready to invest, the worse this bias gets. Crypto investors lacking proper research often under assume that, like stocks, cryptocurrencies aren’t fractionalized. They think they can only be bought in whole units. Even if an investor understands this misconception, the bias attached to owning a full unit is still a blind spot for participants at all levels. Let’s dig in.

Mechanics of Bitcoin

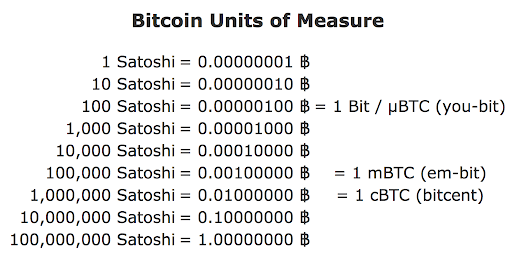

When it comes to owning Bitcoin, you must understand how the asset works. One Bitcoin consists of 100 million fractionalized units called satoshis. A satoshi is just a fancy name for a fraction of a Bitcoin, specifically 1/100,000,000. This is the smallest unit of Bitcoin that can be held in a wallet and is currently worth a fraction of a penny. At the time of writing, $1 is worth 2,722 satoshis. This is where the mantra “stacking sats” comes from. It is the action of slowly adding to your Bitcoin position.

While on the topic of satoshis, there are a couple of disagreements surrounding the intuitiveness and practicality of the term. First off, there is an age-old argument in the crypto community to change the term “satoshis” to “bits.” Satoshi is not an intuitive name for part of a Bitcoin and tends to cause confusion. Advocates argue “bits” is more phonetically pleasing and intuitive.

If you own a small amount of Bitcoin, your balance may look something like this .00005269 BTC, this .00052626 BTC or this .00526653 BTC. Respectively, these amounts at the time of writing are worth $2, $20, and $200, all of which are equally confusing and hard to look at. This is why many Bitcoiners are beginning to push for exchanges to switch the Bitcoin unit of account to satoshis. These balances would no longer appear as decimals. Instead, they would appear as 5,232 sats, 52,327 sats, and 523,270 sats– numbers that are far more digestible at first glance.

At the least, it makes sense for exchanges to offer both units of accounts as an option. In the future, we may see platforms change the unit of account to “satoshis” and switch the name to “bits.”

The Bigger Picture

If you haven’t picked it up by now, anyone can afford to own some satoshis if you have access to an internet connection. Owning part of a bitcoin doesn’t have to be expensive. One tool displays how many sats there are per person in the world, which you can check it out here. The number is always changing but as a rough estimate. As of now, there are only 234,126 satoshis per person in the world.

The calculation is based on the world population and circulating supply. This equates to about .0023 Bitcoin or $88 USD per person. It feels meaningful and well-designed that each person in the world could have over 200,000 sats, if evenly distributed. It also makes you realize how early we are.

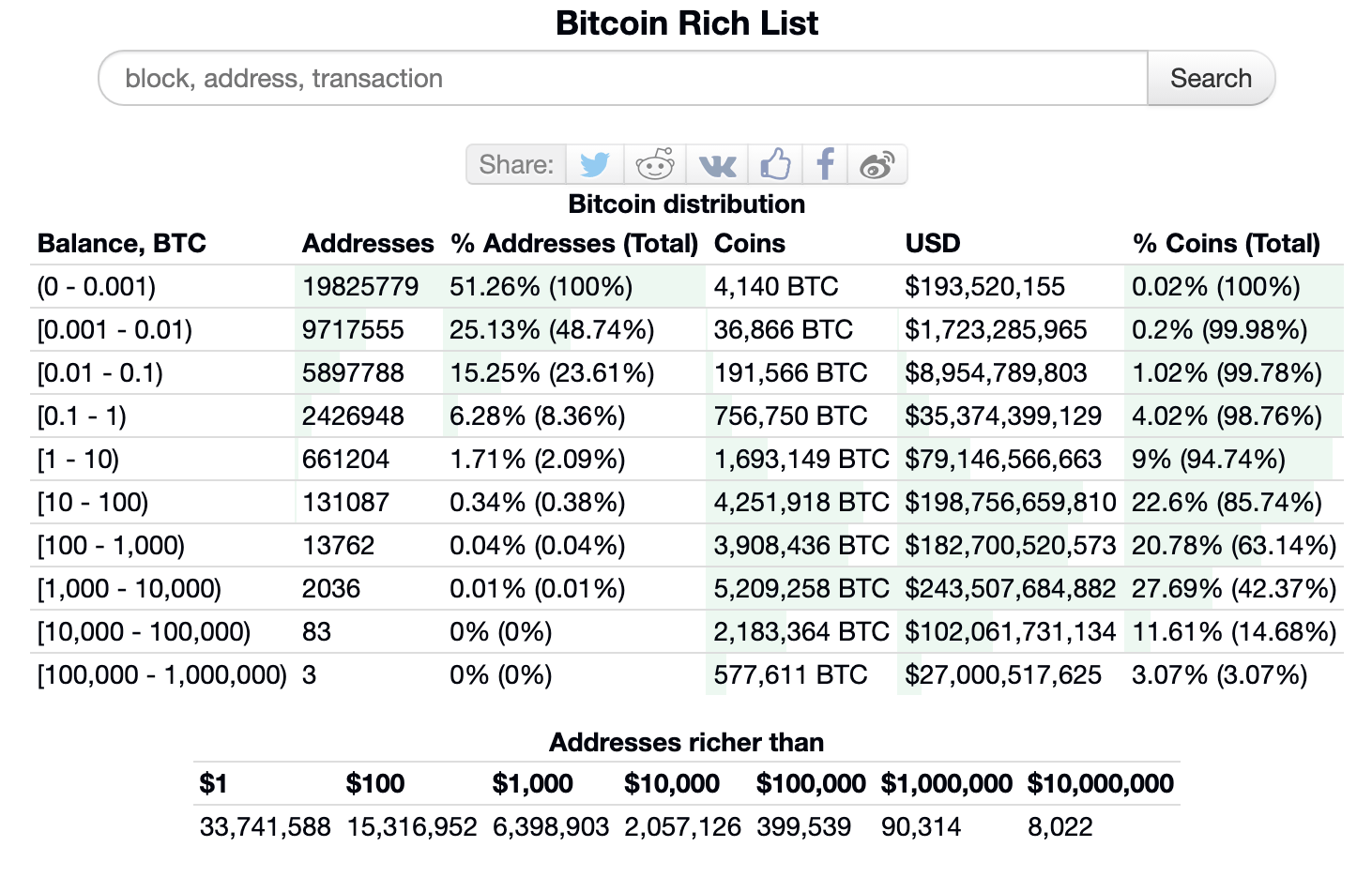

Another great tool to analyze Bitcoin’s breakdown is the Bitcoin Rich List. It’s a novel way of looking at the distribution of the coins held in all Bitcoin wallets. This gives you an idea of what percentage of the world you fall into based on how many sats you have stacked.

If you have been around for a while, hopefully you have stacked close to .1 BTC or more. Surpassing .1 BTC means you are ahead of 90% of the world’s Bitcoin-owning population. And if you happen to own Ethereum or any other coin, you’re probably even higher on the list since all other cryptocurrencies are younger than Bitcoin. You have arrived before the masses and are “early.” Anyone can make it on the Bitcoin rich list. It takes just 1 sat. And if you make stacking your hobby, shoot for the top 10% of HODLERs. While we are early, it is still very achievable.

Don’t Give In to Unit Bias

Now let’s take a look at one of the root causes for misconceptions surrounding the asset. Unit bias is a large attribute deterring newcomers and retail traders from purchasing Bitcoin. It may actually be your largest blind spot.

Unit bias can be defined as: the tendency for people to want to complete a unit of a given item or task. People believe there is an optimal unit size and want to get through to the end because they get satisfaction from completing it – Lirio.com.

This is why we find it unsatisfactory to see .034 BTC in our wallet and end up buying 10 LTC or another larger amount of a cheaper asset. This could also be the reason we over or under-allocate on some assets to hit perfect round numbers.

When it comes to investing, cheaper assets do not mean better, and they do not mean greater return. The actual cost of an investment– stocks, bonds, or digital assets– is actually a useless figure in the grand scheme of things. In terms of numbers, more relevant is the size of the market cap, daily volume, distribution, liquidity, and circulating supply. In general, if you plan to look at the numbers, aim for a coin with a large market cap, wide distribution, high volume/liquidity, and low/fixed/near fixed supply.

If you aren’t following these basic principles, you’ve likely found yourself a higher-risk asset. Take any altcoin for example. During the last major drop, Bitcoin dropped close to 55%. Many altcoins lost +75%, which is a really big difference recovery-wise. If an asset worth $100 drops 55%, it needs a 122% increase to recover. A 75% drop needs 300%.

Don’t fall victim to unit bias. At the end of the day only you see your portfolio. It does not need to have perfect round numbers or boast a high amount in one coin. If Bitcoin is the right investment for you, buy an amount according to your strategy, not your feelings.

There is a reason the Bitcoin Rich List is named what it is: everyone on the list is rich. That means just 1 satoshi is enough to put you ahead of the general population. And once you acquire one, the sky’s the limit. If you are thinking about buying, just keep in mind that time in the market beats timing the market.