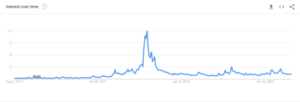

The 2017 Bitcoin bull run was fueled primarily by retail fomo – fear of missing out. At the end of the year, we saw bitcoin as a major headline in the mainstream media, average Joes were throwing their paychecks into Coinbase accounts and Thanksgiving dinner was an opportunity to shill coins to your family. This can be seen clearly by looking at the above chart – google searched of “bitcoin.” There was a huge spike in 2017, proving that retail was interested in crypto. As you can see, we have barely seen a rise at all in 2020.

It was a true bubble, which burst in dramatic fashion at 2018.

One of the most famous quotes in trading is this – ‘The four most dangerous words in investing are: ’this time it’s different’ – John Templeton.

Well, that’s true, but I believe that this time IS different.

The signs are everywhere. The United States has moved to allow banks to custody crypto for their clients, VISA and Mastercard are forging a path towards making crypto more usable, the CASH app is doing billion in revenue selling Bitcoin, PayPal and Venmo are opening the door to crypto for 320m people and Grayscale is buying more Bitcoin and Ethereum than is being mined to repackage and sell on the US Stock Market. Bitcoin’s strength is buoyed on institutional investment – not retail.

This time IS DIFFERENT.

And it is FAR better.